This article was first published on the WeChat public account: Hunting Cloud. The content of the article belongs to the author's personal opinion and does not represent the position of Hexun.com. Investors should act accordingly, at their own risk. Text | Hunting Network (ilieyun) Lu Yangping Remember the "Happy Farm" stealing game launched in 2009? Recently, the development of Happy Farm's developer merchant game announced that the company's stock will be officially listed on the national share transfer system from February 15th. The transfer method is the agreement transfer. According to the previously published "Public Transfer Book", from January to April 2016, Renren Games achieved revenue of 24,361,900 yuan, net profit of 6.437 million yuan, and the valuation of the listed new board was 348 million yuan. Everyone's game listing on the new three board seems to give everyone a nostalgic opportunity, Hunting Network (WeChat: ilieyun) also take an inventory of the listed three new Internet companies to see the performance of these companies after the listing. Drowsy old internet company on the new three board Everyone's game listing on the new three board is actually a microcosm of many Internet companies entering the new three boards in the past two or three years. Like the old-fashioned Internet companies, everyone is also a network of companies, ST Tianya, Rising Information and Rehabilitation Culture. All four companies are currently caught in the slump of losses. Among them, Zhongsou Network has recorded a total loss of 493 million yuan since its listing in 2013. In addition to the dismal performance, the troubles continue. In June 2016, Zhongsou.com was complained by customers due to internal control problems, and the stock was transferred to the innovation layer. On February 6, 2017, due to labor disputes, Zhongsou.com was included in the list of untrustworthy persons and the Wuhan Branch was included in the list of business exceptions. For Zhongsou.com, the new three boards are listed or a watershed. Before listing, there was no loss in Zhongsou. Dongcai choice showed that the net profit recorded in 2011 and 2012 was 60.15 million yuan and 41.21 million yuan respectively. The old Internet companies that once had a good time collectively chose the new three boards, but the new three boards did not give a strong answer to their future. Instead, these companies are more like sleeping pills after they are listed, sleepy, and the New Third Board is likely to be their last stop. With a fixed increase of 1.18 billion yuan, Jingyu Culture has become one of the most promising Internet companies in the New Third Board. Unlike the old Internet companies that may be old in the New Third Board, outstanding Internet companies are no longer satisfied with the New Third Board market, and the landscape culture is one of them. On January 3, the parent company of the Mama Travel Network parent company announced that it intends to apply for stocks to the national small and medium-sized enterprise share transfer system to terminate the listing. For the reasons for the active termination of listing, Jingyu Culture stated that it is for the company's strategic development needs and the next step for greater and farther capital operation services. Jingyu Culture was listed on the New Third Board on December 22, 2015. Its main business includes two online and offline sectors. The online business mainly focuses on online sales of tourism products, with tickets, destination tours, domestic tours, and outbound tours. And a variety of business including business travel; offline business mainly includes tourism planning, tourism marketing and scenic area operations. From the perspective of financial data, the performance of Jingyu Culture in recent years is in a state of sustained high growth. In the whole year of 2015 and the first half of 2016, the company's operating income was 3.1 billion and 2.7 billion, respectively, up 123% and 163% year-on-year, which was ahead of industry competitors. More than a year has passed since the listing of the New Third Board. The Jingyu culture has been completed twice, with a total financing of 1.18 billion. It is one of the most promising Internet companies in the 2016 New Third Board. The total number of listed Internet companies exceeds 3,000, and the new three boards are brought together. There are both companies that support the elderly on the New Third Board and potential stars that have emerged from the New Third Board. In fact, the magic of the New Third Board for Internet companies is much greater than this. As of February 15, the number of TMT companies in the Internet and information technology listed on the NEEQ reached 3,355, accounting for 31.61% of the total number of listed companies. Why did the New Third Board become a gathering place for Internet companies? The NEEQ has no profit limit threshold, short reporting process, flexible financing methods, and a series of advantages such as future transfer mechanism and bidding transaction, which attracts the attention of Internet companies. It is precisely because of the many advantages of the New Third Board, coupled with the successful case of the company's return to A shares, such as Stormwind 300431, Shares, Focus Media and other companies, the domestic Internet companies in the growth stage have strengthened their confidence in staying in domestic financing development. The board is still hot, low liquidity is difficult to block the star companies fleeing in groups On the other side of the board market is still hot, at the beginning of the new year, many star companies will publish announcements to prepare to "escape" the new three boards, such as heroes, entertainment, scenic culture, group loan network parent company Guangyingxia and so on. In the one and a half months from 2017 to the present, a total of 65 companies have applied for delisting, and the number of listed companies that have been delisted from the New Third Board in 2016 is 56. Overall, the trend of the New Third Board market in 2016 is not ideal. On the one hand, it has experienced the problems of madness, financing difficulties and insufficient liquidity. On the other hand, the regulatory authorities have comprehensively and strictly regulated the market. "The effect has gradually emerged. Therefore, after nearly two years of fiery market, Internet companies have become more rational in choosing to enter the New Third Board, but it is undeniable that the potential benefits such as the transfer mechanism and the bidding trading system still attract many companies to continue to land in the New Third Board. Looking back on 2016, the size of the NEEQ market continued to fluctuate in 2015, and the number of listed companies doubled from 5,129 to 10,163 (as of February 15, 2017, the number of NEEQ listed companies reached 10,584), but the total market value is only It has increased by 64.97% (from 24,584.42 to 40,558.11). The annual transaction volume is only 191.228 billion yuan, only more than 200 million more than in 2015, and as many as 6,978 listed companies have no transactions within 250 days. Since 2013, the number of new three-board companies has doubled continuously. After more than four years of development, it has broken through the Wanjia Pass, reaching 10,649 (as of February 15), and the rapid growth is still continuing. In 2017, it was only one and a half months. The number of listed companies has increased by 486, with an average of more than 10 listed companies per day. The New Third Board is still an important way for companies to enter the capital market. (Recovery Network Research Institute) The increase in quantity is hard to hide the decline in the market value of individual companies. Compared with the average market value of listed companies in 2015, it has reached 479 million yuan. In 2016, it has dropped to 399 million yuan, a drop of nearly 20%. At present, the top 10 new three board companies with the highest market value are Jiuding Group, Shenzhou Youche, Silicon Valley Paradise, Black Gold Times, Jiuxian.com, Evergrande Taobao, New Industry, Nanjing Securities, Donghai Securities, and Universiade. The total market value is 304.8 billion yuan. , accounting for 7.5% of the overall market value of the new three board companies. In the top ten of the list, the companies related to the Internet concept only have two cars, namely, UCAR and Jiuxian. In addition to the rising number of companies listed on the New Third Board, the number of companies delisting from the New Third Board is also increasing. Since the second half of 2016, the trend has become more apparent. The number of delistings in the first half of the 56 companies that were delisted throughout the year There were only nine, and the number rose to 47 in the second half. In 2017, just one and a half months after the opening of the year, 15 companies have been delisted from the New Third Board. According to this speed, more than 120 companies will be delisted from the New Third Board during the year. (Recovery Network Research Institute) In 2016, there were five main reasons for the delisting of 56 companies: mergers and acquisitions, business adjustment and business needs, development strategy adjustment, forced delisting and transfer listing. Enterprises took the initiative to apply for delisting more than half, of which forced to withdraw from the market. It is impossible to disclose the annual report or the semi-annual report in time. Low liquidity is the main reason for the company's active delisting. Compared with other domestic capital markets, the trading activity of the NEEQ listing market is not high enough, the overall transaction scale is still small, and the annual turnover rate is much lower than other sector markets. There are still some companies that have no interest after listing, and no transactions have taken place. These phenomena have to be improved from liquidity. (Recovery Network Research Institute) The 56 listed companies that delisted in 2016 had an average listing time of less than 14 months, of which the number of companies was the highest in the period of 6 to 12 months, reaching 19 companies. After 20 days of listing, Guotu Information (834724) announced that all the shares were acquired by the listed company SuperMap Software 300036, which was acquired by the stock company (300036.SZ), ranking second in the history listing time. The first name was 2015 Zhongyi Pharmaceutical Co., Ltd. The shortest listing record for 29 days. The rumors that the securities business's New Third Board business unit is in a state of abolition are adding to the shadow of the uncertainties of the New Third Board. Although it was eventually denied, it is an indisputable fact that the growth rate of the New Third Board market is drastically reduced. According to the data, since August 2014, Zhongtai Securities and Shanghai Securities ranked third and fifth in the number of stock market rankings, with 289 and 251 respectively, but since October 2016, Zhongtai Securities Shanghai Securities has only 1 and 4 new market-making stocks. The total number of new market-making stocks such as Huafu Securities and Century Securities has remained at more than half a year, and business suspects have stagnated. The new three board breaks the prospect Overall, the trend of the New Third Board market in 2016 is not ideal. On the one hand, it has experienced the problems of madness, financing difficulties and insufficient liquidity. On the other hand, the regulatory authorities have comprehensively and strictly regulated the market. "The effect has gradually emerged. The data shows that the CSRC penalized 183 cases in 2016 and made 218 administrative penalty decisions, an increase of 21% over the previous year. The total amount of fines and penalties was 4.283 billion yuan, an increase of 288% over the previous year. The ban was increased by 81% from the previous year. The number of administrative punishment decisions and the amount of fines and penalties all reached record highs, and the number of people banned in the market also reached historical peaks. In 2017, the institutional norm is still the focus of the development of the New Third Board, but it may be more focused on market development and innovation. The listing will expand from a single dimension to a more focused quality improvement; the delisting system will be implemented and some of the results will be phased out. Poor enterprises; there may be breakthroughs in the establishment of multi-level markets and pilot transfer. 1. Innovative layer reshuffle, multi-level market establishment At the end of April, 950 new three-board innovation companies will usher in the first “big reshuffleâ€. According to the previous three-tier tiering system of the stock transfer system, the first transfer day of the last trading week in May will be adjusted. The level of the hierarchy. Listed companies that do not meet the requirements of the innovation layer will be transferred to the base layer, and the base layer companies that meet the conditions of the innovation layer will be transferred to the innovation layer. The current tiered system of the New Third Board only gives a list. There is no difference between the innovation layer and the base layer in the trading system. The stratification and re-layering have caused many people in the market to discuss it. The current innovation layer and the base layer are two. The layer structure is not enough to support the current development of the NEE, and re-stratification will help improve the existing valuation system of the NEEQ. Liu Shiyu, chairman of the China Securities Regulatory Commission, also said at the supervisory work meeting on February 10 that the tiered system and tiered approach of the listed companies in the New Third Board need to be optimized. Compared with re-stratification, it is more important to match the trading system associated with it. The trading system for the current agreement transfer and market-making transfer of the New Third Board cannot meet the needs of the development of the new three-board market. The number of domestic individual investors is huge. The agreement transfer and market-making transfer are more suitable for transactions between institutional investors. In the immature market environment of institutional investors, the current trading system is not conducive to active market transactions. The bidding transaction system is currently the most popular. Introduce trading methods. 2. Pilot to GEM/board transfer board Recently, the party committee of the Shenzhen Stock Exchange held a special meeting to conscientiously study and implement the spirit of the 2017 National Securities and Futures Supervision Work Conference and deploy and implement the various tasks of the conference. The meeting pointed out that this year we must improve the construction of a multi-level market system, deepen the reform of the ChiNext, promote the pilot of the New Third Board to the GEM, and support a number of outstanding enterprises with strong innovation capabilities, broad development prospects and national development strategy orientation. According to Choice statistics, the average return on equity of the innovation layer in 2015 was 18.78%, much higher than the 10.34% of the GEM. However, the price-earnings ratio was only 21.17 times, far lower than the 69.95 times of the GEM. In addition, 875 of the 951 innovation-level companies in the New Third Board are financially in line with the GEM IPO requirements. In 2017, A-shares can be integrated into three IPOs per day on average. The rapid development of A-shares has also led many innovative companies to seek the intention of “transferâ€. As of February 14, a total of 86 listed companies in the New Third Board have been carried out. The IPO is the first to declare, belonging to 38 innovations, and the remaining 48 are basic companies. Since the launch of the National Market System (NMS system) in 1982, after 35 years of development, Nasdaq has made a non-threshold, rough offer section into a mainstream, meticulous listing section, Apple, Google, Tesla, Microsoft ... a group of epoch-making companies were born here. In 2017, the Nasdaq index hit record highs, and Apple reached the top of the world's largest company with a market value of US$659 billion. Nasdaq's vice president and IPO director Joseph Brantak said there are currently 96 shares in 2017. Of the annual listing applications, 53 of them will choose to list on NASDAQ. The New Third Board has many similarities with Nasdaq, and it has the advantage of being blue and blue. But the new three board is still only a teenager. It has become an incubator and a hotbed of modern technology. It requires more patience and Internet creation. We should avoid following the trend and taking advantage of the opportunities to grasp the opportunities brought by the New Third Board. Shenzhen Hongxiangwen Hook&Loop Co.,Ltd , https://www.hxwsports.com

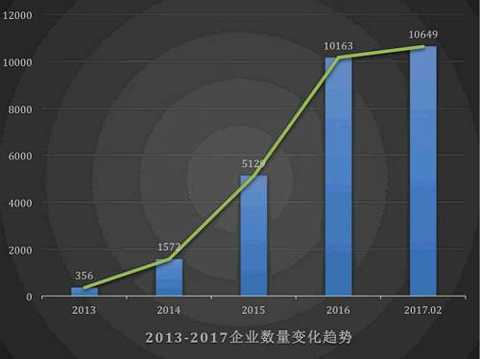

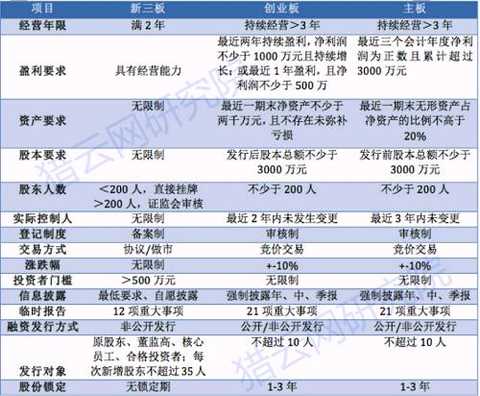

“From the perspective of valuation methods, the New Third Board is also more suitable for Internet companies.†A new third-board market leader of a brokerage pointed out that the traditional A-share valuation needs to analyze the company’s profitability, solvency, growth and other indicators. Refer to the pricing of existing similar enterprises in the market to judge their fair value. This is not representative of Internet companies whose innovation means are constantly updated. The market-making mechanism of the New Third Board market, through the comprehensive understanding of the company's situation, determines the price according to market demand, giving Internet companies valuation. More imagination.